Pakistan International Airlines (PIA) has officially moved closer to privatisation as the Arif Habib Group-led consortium secured the winning bid at Rs135 billion. The bidding process saw strong competition, with Lucky Cement Group raising its offer to Rs134 billion before falling short.

During the second phase of the privatisation auction, open bidding resumed after initial offers were disclosed. Lucky Cement initially placed a bid of Rs120.25 billion, which was quickly surpassed by Arif Habib Group with Rs121 billion. Following a brief extension of 30 minutes for further bids, the Arif Habib-led consortium ultimately submitted the highest offer of Rs135 billion. Other participants included Airblue Group, which bid Rs26.5 billion.

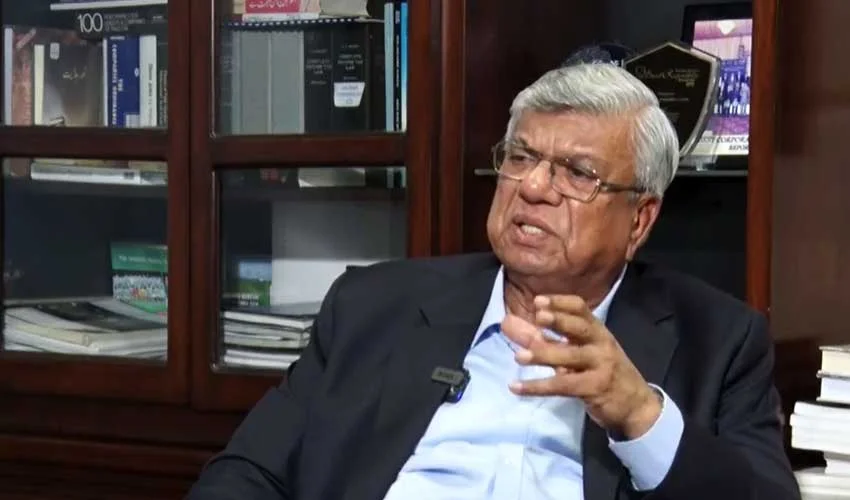

Privatisation Adviser Muhammad Ali emphasised the strategic importance of PIA’s privatisation as part of the government’s broader agenda. He noted that the successful bid would unlock new investment opportunities and revitalise the national carrier. The sale pertains to 75 percent of PIA’s shares, a figure revised from an earlier plan to sell 51–100 percent. A further 25 percent stake is planned to be offered within 90 days.

According to the adviser, 92.5 percent of the funds from the privatisation will be reinvested in PIA for fleet expansion and operational improvements, while the remaining 7.5 percent will contribute to government revenue. The plan includes increasing the airline’s aircraft fleet from 18 to 100, with payments to be received in stages. Two-thirds of the payment for the 75 percent stake will be made upfront, ensuring immediate capital injection for the airline.

Muhammad Ali also highlighted the flexibility for additional parties to join the winning consortium, including the potential participation of another airline for strategic investment purposes. The privatisation marks a significant step in modernising Pakistan’s aviation sector and attracting private-sector expertise and capital.