How to Become a Filer: A Step-by-Step Guide

Are you looking for a complete guide on ‘how to become a filer’ in Pakistan? Then you are at the right place. This article aims to provide a comprehensive guide on the topic and by the end, you will be able to know about all the steps in detail required to become a filer.

Alongside filing your taxes, it must be remembered that it comes with many benefits and legal obligations. Let’s begin and check out the process:

How to become a filer in Pakistan?

The steps to becoming a filer in Pakistan includes:

Get an NTN Number:

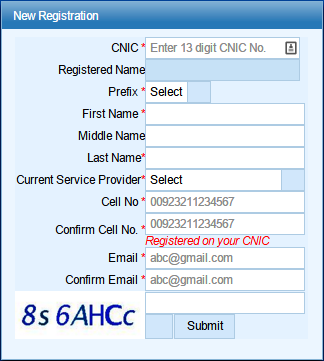

An NTN number is mandatory and the core step while looking to become a filer. If you do not have an NTN number, you can visit the website to get yourself registered by clicking on registered for an unregistered person. You will be required to fill in a simple form following the procedure to log into the IRIS system. Notably, you can find the form in the draft folder. After completing the form, you are likely to get your NTN number within an hour.

Once you get an NTN number, submit your tax return for tax year 2023 to become a filer.

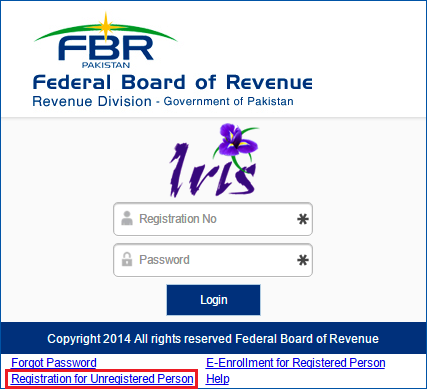

How to Register for an Unregistered Person?

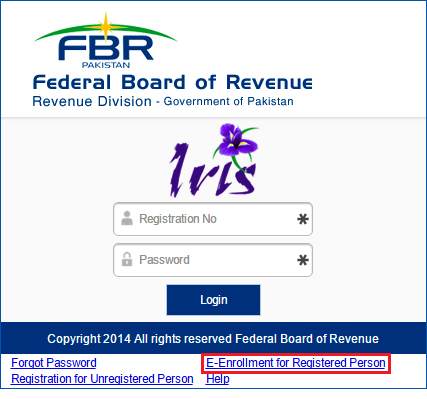

In order to register yourself if you are an unregistered person, click on ‘registered for unregistered person’ at the bottom as shown in the photo above. If you are a first-time user, then you can find it at ‘https://iris.fbr.gov.pk/public/txplogin.xhtml‘.

After providing the information required, you will be asked for confirmation input to validate your account. For this purpose, check your phone SMS, or Email. Then, you will be sent a password to log in. Remember that this process may take up to 24 hours for scrutiny purposes.

You will be again redirected to the login page for the IRIS system. Enter your credentials to continue with the further process. It is pertinent to mention again that you can register ‘for an unregistered person’ if you have not registered before.

Fill out the Form

Once you are done with step 2, you will be given a form. A dialogue box will open asking for details like name, email, and service provided. Fill them out and submit them. After that, you will be required to confirm your email and phone number. Check your email and SMS for separate/codes. Insert the code in verify dialogue box, or if it is a link in the email, click to verify and proceed.

Now, you can log into your account using CNIC and the password sent to your email sent before. Remember to save any PIN Code, received during any process. You may require it over and over again.

How to Enroll for Registered Person?

If you look at the right bottom corner, you will see a clickable link, enrolment for registered person. Click there. It is for people who already have an NTN number but no IRIS username or password.

After submitting the required details, you will be prompted to verify your email address and phone number. Separate verification codes will be sent to both your email and mobile number.

Once you have submitted the verification codes and successfully verified your email and mobile, you will receive a text message containing your registration number. This registration number will be the same as your ID card number, without any dashes or spaces. Additionally, the text message will provide you with a password and a pin code.

To access your Iris account, simply log in using your registration number (CNIC number) and the provided password.

Prepare Your Wealth Statement

Now, you have to provide your wealth statement and income tax returns for becoming a filer. After registering and logging into your account, you can now file your wealth statement. If you are a salaried person, you will be required to fill out wealth statements and income tax returns. If you are not aware of how to fill out a wealth statement, click here: https://e.fbr.gov.pk/SOP/SideLinks/iris_help.pdf.

Points to Remember:

- Only individuals can register through the e-filing system. Associations of persons and companies have a slightly lengthier process.

- E-filing is applicable for income tax returns but not for sales tax returns.

- A cell phone with a SIM registered against your own CNIC is needed.

- A personal email address that belongs to you is needed.

Scanned PDF files of the following documents:

- Certificate of maintenance of a personal bank account in your own name.

- Evidence of tenancy or ownership of business premises (if you own a business).

- A paid utility bill of the business premises, not older than 3 months (if you own a business).