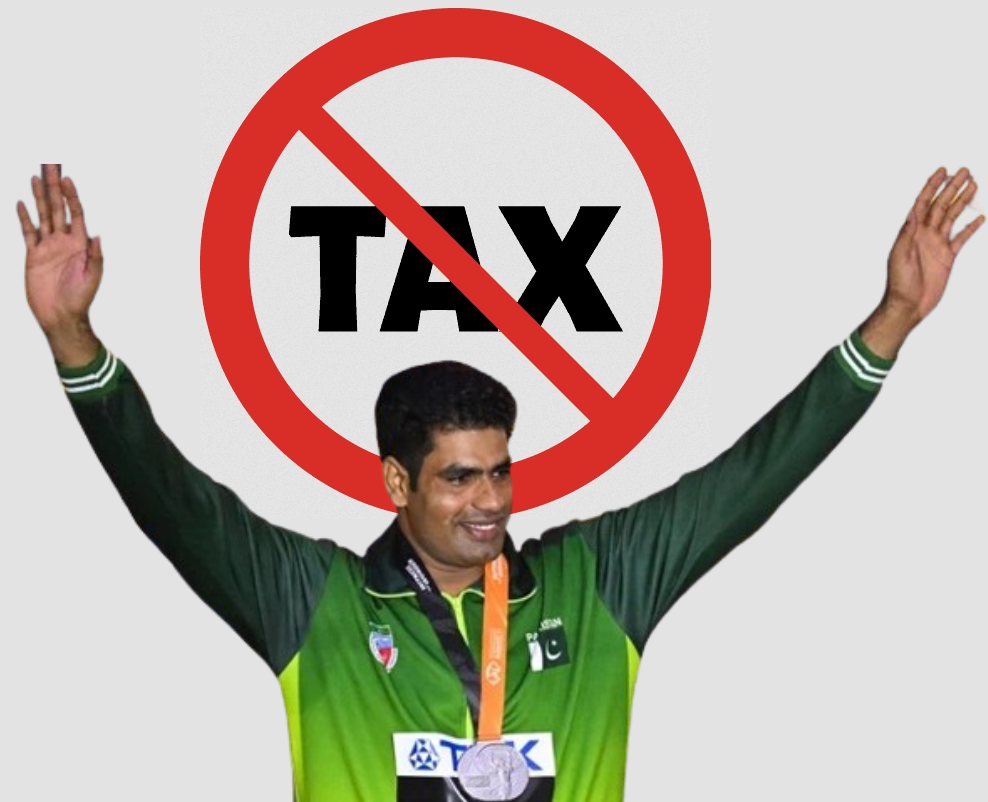

FBR Confirms Arshad Nadeem’s Olympic Prize Money Will Remain Untaxed 2024

The Federal Board of Revenue (FBR) has officially announced that the prize money awarded to Pakistan’s Olympic gold medalist Arshad Nadeem will not be subject to income tax or withholding tax. This declaration comes as a relief to many, ensuring that the athlete’s hard-earned rewards will remain untouched by tax deductions.

Bakhtiar Muhammad, the FBR spokesperson, clarified in an interview with ProPakistani that Pakistan’s income tax laws do not impose taxes on rewards received for achievements in the Olympic Games. This exemption is specifically designed to honor and support national heroes like Arshad Nadeem, who have brought immense pride to the country.

“Arshad Nadeem is a national hero, and we will extend all possible support to him,” stated the FBR spokesperson, reaffirming the government’s commitment to recognizing and celebrating the achievements of its athletes without imposing unnecessary financial burdens.

Clarification of Income Tax Ordinance

The spokesperson further elaborated on the specifics of the Income Tax Ordinance, particularly Section 156, which outlines the instances where prize money is subject to taxation. According to this section, taxes are applicable on prize money obtained through prize bonds, lotteries, quiz competitions, and sales promotions given by companies. However, these regulations explicitly do not apply to rewards given for achievements in sports, particularly at the Olympics.

This clarification is significant as it dispels any misconceptions that may have arisen following Arshad Nadeem’s historic victory. The athlete’s achievements, including his gold medal win, are to be celebrated and not taxed, ensuring that the full amount of his prize money can be used for his personal and professional development.

Public Reaction and Government Support

The announcement by the FBR has been met with widespread approval from the public, who view it as a just recognition of Arshad Nadeem’s extraordinary efforts. Nadeem’s victory in the javelin throw at the Paris Olympics 2024 marked a historic moment for Pakistan, ending a 32-year medal drought and securing the country’s first-ever individual Olympic gold.

Given the significance of this achievement, many believe that exempting his prize money from tax is a small yet meaningful way for the government to honor his contribution to the nation. The government’s stance is seen as a positive step toward encouraging future athletes by ensuring they are not penalized for their success.

The decision not to tax Arshad Nadeem’s prize money also aligns with a broader trend in many countries where athletes who achieve significant milestones in international sports are often granted tax exemptions as a form of recognition for their efforts and the honor they bring to their home countries.

A Step Forward for Pakistan’s Sports Sector

This move by the FBR could potentially set a precedent for how the country treats its athletes financially. With Pakistan striving to improve its standing in international sports, such supportive measures can play a crucial role in motivating athletes to aim higher. Financial incentives, free from the burden of taxation, provide athletes with the necessary resources to invest in their training, equipment, and overall well-being, which are essential for sustained success at the highest levels of competition.

Moreover, this decision could also encourage more youth to pursue sports professionally, knowing that their achievements will be recognized and rewarded fully by the state. The government’s clear message is that it stands behind its athletes, ready to support them in their journey to bring glory to the nation.