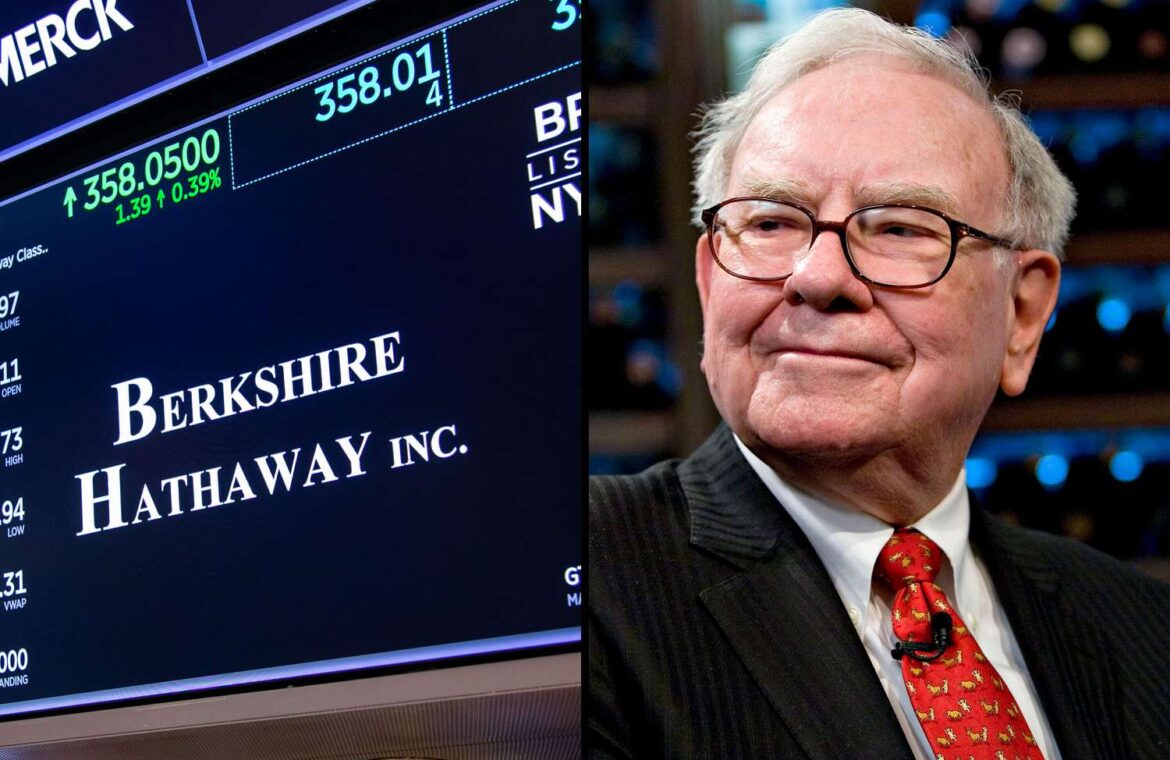

Warren Buffett, the legendary investor and longtime face of Berkshire Hathaway, announced a major transition during the company’s annual meeting. After six decades at the helm, the influential billionaire investor will step down as CEO at the end of the year, handing the leadership role to Vice Chairman Greg Abel.

Buffett, now 94, surprised even Abel with the announcement, stating it was time for the next generation of leadership. “I think the time has arrived where Greg should become the chief executive,” Buffett said. Despite the shift, he confirmed he has “zero” intention of selling any of his Berkshire stock.

Buffett’s decision marks the end of an era. Under his stewardship, Berkshire Hathaway transformed from a modest textile business into a trillion-dollar investment powerhouse with $300 billion in liquid assets. Revered for his long-term strategies and sharp market insight, the influential billionaire investor earned global respect, and the moniker “Oracle of Omaha.”

Influential Billionaire Investor Buffett Warns Against Weaponizing Trade

In a pointed aside during the meeting, Buffett also criticized America’s recent trade policies. Without naming former President Donald Trump directly, he cautioned against using tariffs as a tool for leverage. “Trade should not be a weapon,” the influential billionaire investor said, warning that such tactics can escalate tensions and weaken international trust.

Buffett stressed that global prosperity is not a zero-sum game. He argued that nations benefit more from collaboration than confrontation, noting, “The more prosperous the rest of the world becomes, the more prosperous we’ll become.” His comments echoed previous criticisms of tariffs, which he’s described as harmful taxes on consumers.

The timing of Buffett’s remarks comes amid fresh debate about US-China trade relations and economic nationalism. He emphasized that alienating global partners can have serious long-term consequences, especially when the world is watching.

Despite the heavy themes of leadership change and global economics, Berkshire Hathaway also reported a 14% dip in quarterly profits, posting $9.6 billion in earnings, or $4.47 per share.